Statute of Limitations for Debts

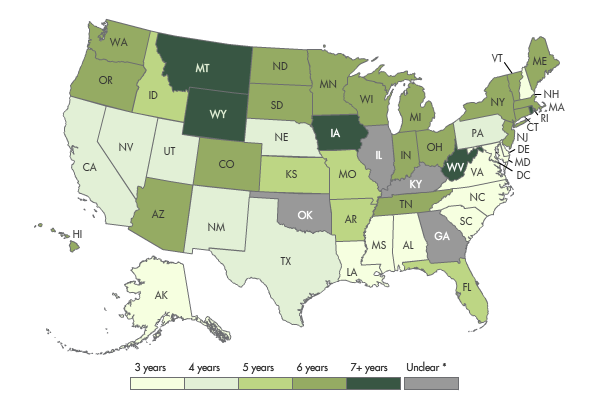

Map shows statute of limitations for debts by state. (Image via creditcards.com)

Statute of Limitations for Debts, Judgments & Taxes: All States

Are bill collectors hounding you? Considering repaying or negotiating an old debt? The statute of limitations on bills, often referred to as the tolling of time, is a powerful tool for consumers. The SOL can thwart lawsuits and collectors when collecting or suing on dusty old debts.

If a debt is legally expired, you can escape being sued or having to pay it back. Likewise, it can be detrimental because many debtors unwillingly renew the SOL by making a partial payment or a written promise to pay, which extends the statute.

The statute of limitations is a civil code. Each state has its own statute, For instance, the code section in Cal. Code of Civil Procedure § 337.

The legal meaning for statute of limitations is THE TIME OF COMMENCING ACTIONS -Time allowed that litigation - lawsuit can be brought. After that time, it expires. The statute is a law. Passed by legislation and varies by state. The original statute of limitations begins at the onset of the contract signing (see more below for time-barred debts).

The statute of limitations varies from state to state, but it is usually 4-6 years, depending on the state. The term statute of limitations means the time allotted to enforce the debt legally. If a statute expires and someone sues you, it is up to you to bring the expired SOL defense.

Don't assume an expired statute of limitations means the other party is barred from attempting to collect. It simply means that your defense is the expired SOL - not to enforce the lawsuit. The statute of limitations for your credit reports is separate. Items on your credit reports are seven years.

Federal Taxes SOL

Tax liens remain on your credit reports for seven years from the date satisfied, not filed. If they remain unpaid, they can stay longer. However, they are only collectible for 6 to 10 years with some provisions. Keep in mind that offers in compromises and payments can extend the tolling of the time (SOL).

State Taxes SOL

Federal taxes expire, but many states have no SOL for state-owned taxes. To know for sure, you need to read your state's codes. You can usually find them at your state's attorney general’s site. From there, locate your state laws and check. Usually, it is under Taxation and Finance Code.

Or visit the State Taxation site and remember if you read the code and cannot find an actual SOL for collecting the tax, then the absence of such usually means there is NO SOL. You must read your own state law to see the tax rule—some report (most) from the date paid while others report from the date opened or filed.

Are there separate rules for debts & credit reporting?

Many people confuse the statute of limitations to collect a debt with the time a debt is allowed to remain on your credit reports. The two are separate. Credit bureaus are allowed a specific time frame to report debts.

Another big fear is that paying it will extend the time it can be reported on your credit. Debts are reported from FIRST delinquency or written off date, not by last activity or last payment. Exclusions would be tax liens. They remain from the date paid for seven years and can remain indefinitely if unpaid.

Paying debt will not restart the clock for reporting it, but you could restart the clock for collecting it, so if you pay it, either pay it in full or restrictively so as to have no worries. A promise to pay or partial payment can renew the statute in many states (you need to read your own state's rule to know for sure); many people think that only a renewed promise to pay does this. That is not the case. Either or can renew the statute.

Signed Under Seal can extend Statute of limitations

A "signed under seal" provision is where some creditors will add it to the contract for further protection. It depends on the contract, but adding a "signed under seal" will generally enforce a longer statute of limitations. The seal must be evident, usually next to the terms on the front page. One also must consider state laws because some may enforce them while others do not. The best thing to do is read the Civil Procedure Code for your state and see if there is a mention.

Not many creditors use a signed under seal, but some do. Courts have long recognized that the presence of the word "SEAL" next to and on the same line as the signature of an individual debtor on a promissory note is legally sufficient. Credit unions often use seals as added protection in case of default, bankruptcy, or expired SOL.

What state should I use in figuring out the Statute of limitations?

The state statute can be either where the debtor lives or where the contract was entered into. The creditor does have the right to choose the state with the longer statute, but the creditor's or collector's location is moot. This is covered in Section 811 of the FDCPA and in Consumer Credit Protection Sec. 1692i.

Here is the rule;

CONSUMER CREDIT PROTECTION Sec. 1692i.

--2) in the case of an action not described in paragraph (1), bring such action only in the judicial district or similar legal entity -

(A) in which such consumer signed the contract sued upon; or

(B) in which such consumer resides at the commencement of the action

NOTE: Actions involving Real Property securing your obligation --the venue is different. The rule is: Any debt collector who brings any legal action on a debt against any consumer shall -

(1) in the case of an action to enforce an interest in real property securing the consumer's obligation, bring such action only in a judicial district or similar legal entity in which such real property is located.

What to do if the debt is not expired & you owe it

You may be "judgment proof" for a time if you are unemployed, on disability, retired, or have no money or assets. If a creditor or collection agency attempts to sue you and you are "judgment proof," then you need to respond to the judgment and state so. Not doing so or ignoring the lawsuit may land a judgment on your credit reports. If you do begin to work again, up to 25% of your pay could be garnished.

You should never ignore the judgment. Even if you are sued, you can often negotiate a reduced payoff to avoid entering the judgment. This will show as a "settled debt" on your credit reports rather than a nasty judgment.

You also need to consider the following before you decide to pay

Is the debt valid? Remember, you have a right to have the debt validated.

Was the product/service defective?

Are the collection fees and interest rates higher than the state allows?

Has the collection agency violated any of your rights under the FDCPA?

The statute of limitations is essential when you have past due or charged-off debts that you cannot or do not want to repay. When a debt is created, there is an original SOL, the date of the contract signing. If you default on new debt - meaning you never even made one payment, then the SOL would be the date you signed the contract.

If you default on debt with payment(s), the SOL would be from the last payment date. Why does this matter to you? Because many, in fact, millions of dollars in debt nationwide have an expired SOL, but consumers rarely know this. If you pay back the debt after the statute of limitation has expired, you have just renewed it, making it collectible for several years.

Using an expired statute of limitations as leverage to negotiate a better credit rating can improve your credit reports. You can have the upper hand by offering the creditor or agency a restrictive offer or telling them to cease and desist because the debt is legally expired. If you have to pay a derogatory debt, shouldn't you try to get the best deal possible? Of course. Don't count on the collection agency or creditor telling you this either.

What about BK's dismissed debt?

If a debtor files bankruptcy, the tolling of time stops. If the bankruptcy is subsequently dismissed, the tolling of time begins where it left off. It does not begin from the date of dismissal.

What category does my debt fall under?

Oral Contract: You've agreed to pay the money back via a verbal agreement. This can include your word, his word, and a witness. These are harder to prove but are recognized as "oral contracts".

Written Contract: You have signed a contract or document promising to repay a loan or debt. An example is medical bills, cell phone bills, closed-end signature loans, or some secured loans like auto.

Promissory Note: It is like a contract loan, except it contains more information about payback. Such information can be interest, principal, late fees, etc. A home loan or HELOC can be a promissory note.

Open-Ended Accounts: Just what it says, "open-end," i.e., a credit card debt or revolving line of credit.

Is a check considered a written contract? What is the SOL for checks?

A check is not considered a "contract," although some may argue that it is (because it's a signed promise to "pay"). A contract requires consideration by both parties (an offer and acceptance) and consists of an (enforceable) promise to pay by one party, but the other party drew up no contract.

What it is, is a negotiable instrument and, therefore, subject to governing UCC (uniform commercial code) if there is one for the state in question. UCC is where you usually find the time limitations on checks. Many states have specific (SOL) statutes of limitations dealing with checks. Those would trump any general statute of limitations and even the UCC limitations.

The UCC is not a federal statute but a system to structure commercial transactions. Since it isn't a federal rule, there would be no supremacy clause (as in who rules, state or federal), but rather the state could choose to adopt it or not. Most states have adopted it.

According to FindLaw, a more specific statute rules over (trumps) a more general statute. Therefore, if a particular state has a more specific statute, it will often trump (rule over) the UCC entirely.

Bottom line: read the UCC but read the state rule and see which one is more specific or offers more protection. You will usually find the SOL for collecting the check in the state code.

“State List of Statutes of Limitations

STATE STATUTE CITATIONS

ORAL WRITTEN PROMISSORY OPEN-END

(State, Code, Years)

ALABAMA Ala. Code § 6-2-2 et. seq. 6 6 6 3

ALASKA Alaska Stat. § 09.10.010 et. seq. 6 6 3 3

ARIZONA Ariz. Rev. Stat. Ann. § 12-541 et. seq. 3 6 6 3

ARKANSAS Ark. Code Ann. § 16-56-101 et. seq. 6 6 3 3

CALIFORNIA Cal. Civ. Proc. Code § 312 et. seq. 2 4 4 4

COLORADO Colo. Rev. Stat. § 13-80-102 et. seq. 6 6 6 6

CONNECTICUT Conn. Gen. Stat. Ann. § 52-576 et. seq. 3 6 6 3

DELAWARE Del. Code Ann. tit. 10, § 8101 et. seq. 3 3 3 4

DISTRICT OF COLUMBIA D.C. Code § 12-301 et. seq. 3 3 3 3

FLORIDA Fla. Stat. Ann. § 95.011 et. seq. 4 5 5 4

GEORGIA Ga. Code Ann. § 9-3-20 et. seq. 4 6 6** 4

HAWAII Haw. Rev. Stat. § 657-1 et. seq. 6 6 6 6

IDAHO Idaho Code § 5-201 et. seq. 4 5 5 4

ILLINOIS 735 Ill. Comp. Stat. 5/13-201 et. seq. 5 10 10 5

INDIANA Ind. Code Ann. § 34-11-2-1 et. seq. 6 10 10 6

IOWA Iowa Code Ann. § 614.1 et. seq. 5 10 5 5

KANSAS Kan. Stat. Ann. § 60-501 et. seq. 3 6 5 3

KENTUCKY Ky. Rev. Stat. Ann. § 413.080 et. seq. 5 15 15 5

LOUISIANA La. Civil Code § 3492 et. seq. 10 10 10 3

MAINE Me. Rev. Stat. Ann. tit. 14, § 751 et. seq. 6 6 6 6

MARYLAND Md. Courts & Jud. Proc. Code Ann. § 5-101 et. seq. 3 3 6 3

MASSACHUSETTS Mass. Ann. Laws ch. 260, § 1 et. seq. 6 6 6 6

MICHIGAN Mich. Comp. Laws § 600.5801 et. seq. 6 6 6 6

MINNESOTA Minn. Stat. Ann. § 541.01 et. seq. 6 6 6 6

MISSISSIPPI Miss. Code. Ann. § 15-1-1 et. seq. 3 3 3 3

MISSOURI Mo. Rev. Stat. § 516.097 et. seq. 5 10 10 5

MONTANA Mont. Code Ann. § 27-2-2021 et. seq. 5 8 8 5

NEBRASKA Neb. Rev. Stat. § 25-201 et. seq. 4 5 5 4

NEVADA Nev. Rev. Stat. Ann. § 11.010 et. seq. 4 6 3 4

NEW HAMPSHIRE N.H. Rev. Stat. Ann. § 508:1 et. seq. 3 3 6 3

NEW JERSEY N.J. Stat. Ann. § 2a:14-1 et. seq. 6 6 6 6

NEW MEXICO N.M. Stat. Ann. § 37-1-1 et. seq. 4 6 6 4

NEW YORK N.Y. Civ. Prac. Laws & Rules § 201 et. seq. 6 6 6 6

NORTH CAROLINA N.C. Gen. Stat. § 1-46 et. seq. 3 3 5 3

NORTH DAKOTA N.D. Cent. Code § 28-01-01 et. seq. 6 6 6 6

OHIO Ohio Rev. Code Ann. § 2305.03 et. seq. 6 15 15 6

OKLAHOMA Okla. Stat. Ann. tit. 12, § 93 et. seq. 3 5 5 3

OREGON Or. Rev. Stat. § 12.010 et. seq. 6 6 6 6

PENNSYLVANIA 42 Pa. Cons. Stat. Ann. § 5501 et. seq. 4 4 4 4

RHODE ISLAND R. I. Gen. Laws § 9-1-12 et. seq. 15 15 10 10

SOUTH CAROLINA S.C. Code Ann. § 15-3-510 et. seq. 3 3 3 3

SOUTH DAKOTA S.D. Codified Laws Ann. § 15-2-1 et. seq. 3 6 6 6

TENNESSEE Tenn. Code Ann. § 28-3-101 et. seq. 6 6 6 6

TEXAS Tex. Civ. Prac. & Rem. Code § 16.001 et. seq. 4 4 4 4

UTAH Utah Code Ann. § 78-12-22 et. seq. 4 6 4 6

VERMONT Vt. Stat. Ann. tit. 12, § 506 et. seq. 6 6 5 3

VIRGINIA Va. Code Ann. § 8.01-228 et. seq. 3 5 6 3

WASHINGTON Wash. Rev. Code Ann. § 4.16.005 et. seq. 3 6 6 3

WEST VIRGINIA W. Va. Code § 55-2-6 et. seq. 10 5 2 2

WISCONSIN Wis. Stat. Ann. § 893.01 et. seq. 5 10 6 5

WYOMING Wyo. Stat. § 1-3-102 et. seq. 8 10 10 8”